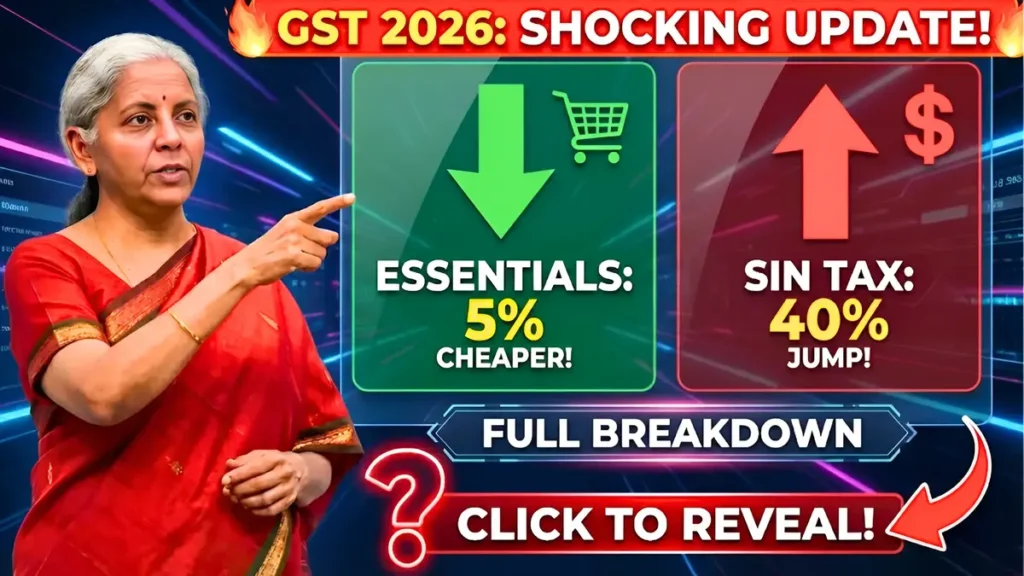

India GST Rate Update 2026: India’s Goods and Services Tax framework is expected to witness notable adjustments in 2026, sparking conversations among businesses, middle-class families, and policy experts. The proposed updates focus on rationalizing tax slabs, increasing sin tax on harmful products up to 40%, and maintaining lower rates on essential goods. These reforms aim to simplify compliance, boost revenue efficiency, and reduce the burden on daily necessities. Here’s a complete, easy-to-understand breakdown of what the 2026 GST update could mean for you.

Why GST Changes Matter

The Goods and Services Tax, introduced in 2017, transformed India’s indirect taxation system into a unified structure. Managed by the GST Council under the Ministry of Finance, GST impacts everything from groceries to gadgets. Any slab revision directly affects product prices, business margins, and consumer spending patterns. The 2026 update is expected to refine rate structures while balancing revenue needs and inflation control, making it a crucial development for households and enterprises alike.

5% Slab For Essentials

One of the most consumer-friendly proposals in 2026 is the continued focus on keeping essential goods within the 5% tax slab. Items such as packaged food, medicines, and daily-use household products are likely to remain affordable under this bracket. The aim is to shield low and middle-income families from inflationary shocks. By protecting necessities from higher taxation, policymakers intend to maintain consumption stability and safeguard purchasing power across urban and rural markets.

40% Sin Tax Strategy

To discourage consumption of harmful products, the government is considering raising the sin tax cap to 40% on select items like tobacco products, luxury cars, and certain high-end goods. This step serves dual objectives—improving public health outcomes and enhancing government revenue. Higher sin tax collections can potentially support welfare schemes and healthcare initiatives. However, experts also warn that excessive taxation may lead to smuggling or tax evasion if not implemented carefully.

Slab Simplification Push

Another major highlight of the 2026 reform discussions is the rationalization of GST slabs. Currently, India follows multiple slabs including 5%, 12%, 18%, and 28%. Policymakers are exploring merging certain slabs to simplify compliance and reduce classification disputes. A simplified tax structure can help businesses streamline billing systems and reduce litigation. If executed effectively, this move could strengthen India’s ease-of-doing-business ranking and enhance investor confidence.

Impact On Consumers

For ordinary consumers, GST revisions primarily influence retail prices. If essential goods remain under 5% and sin products face higher taxation, daily budgets may remain stable while luxury consumption becomes costlier. Middle-class households may benefit from reduced complexity and more transparent pricing. However, final impacts will depend on how companies pass on tax benefits or additional costs to customers. Monitoring post-implementation pricing trends will be crucial in 2026.

Business And MSME Outlook

Small businesses and MSMEs are closely watching the proposed reforms. A simplified slab system may reduce compliance burdens and filing complexities. Lower classification disputes mean fewer penalties and smoother audits. Additionally, clarity in rate structures can improve supply chain planning. Businesses dealing in high-tax goods, however, may need to adjust pricing strategies if the 40% sin tax becomes reality. Overall, predictability in taxation remains the key demand from industry leaders.

Revenue And Fiscal Goals

From a fiscal perspective, GST collections play a vital role in funding infrastructure, welfare programs, and state allocations. Enhanced sin tax rates could strengthen revenue streams without pressuring essential goods. Rationalized slabs may also widen compliance and reduce leakages. Authorities aim to strike a balance between revenue growth and economic expansion. Sustainable tax reform ensures that growth momentum continues while maintaining macroeconomic stability in the coming years.

Final Word: India GST Rate Update 2026

The India GST Rate Update 2026 signals a strategic shift toward protecting essentials, discouraging harmful consumption, and simplifying tax structures. While final approvals and notifications will determine the exact impact, the direction appears focused on balance and stability. Consumers may benefit from affordable necessities, businesses may gain from clarity, and the government could improve revenue efficiency. As reforms unfold, staying informed will help individuals and enterprises make smarter financial decisions in 2026.

Disclaimer: This article is for informational purposes only and is based on publicly available reports, policy discussions, and market expectations regarding GST updates for 2026. Tax rules and rates are subject to official notifications by the Government of India and the GST Council. Readers are advised to consult official government sources or a qualified tax professional before making any financial or business decisions.